Understanding the questions behind a VC’s questions: Part 4 — How high is the summit?

Blazing a trail to the top

This is the fourth in a series of posts written to expose the analysis behind investor questions and to propose a simple framework to help entrepreneurs guide pitch meetings more effectively. I invite you to read the first, second and third posts as well.

The size of the opportunity and your ability to capture it are the drivers of investment and are the primary focus of my conversations with entrepreneurs. When we have both done our homework, this is the most enjoyable part of my day because I get to learn about a new technology or service that may change the world from the person who is passionate about making it happen. When I was out raising money, this was my favorite part of the pitch because I got to talk about my passions and the cool thing I was building.

Investors will typically lead with these questions because the opportunity size is a primary screen. If the market is not big enough, there is no need to evaluate the risks of a given investment or come to any conclusion about the ability of the team to capture it.When you pitch, you know that accurately sizing the market and understanding the key drivers of customer adoption help frame the opportunity for an investor. Because of this, clarity about what you are building, how you will sell/distribute it and comfort with both top-down and bottom-up estimates of the market are extremely valuable. Starting off a meeting by showing that you are attacking a big ass market with a kick ass team (Rob Hayes’s “two asses” theory) is the best way to frame the conversation. Your excitement for what you are doing and the reasons you have been compelled to build a company around your idea needs to carry you through the parts of the meeting focused on evaluating the investment risks. This is your time to shine as a founder.

DESCRIBE YOUR PRODUCT/SERVICE

- What is your product/service?

- How does it solve your customer’s problem?

- What is unique about your product/service?

WHAT IS YOUR VALUE PROPOSITION?

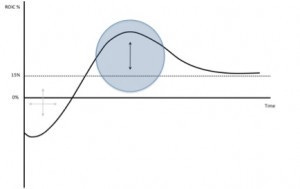

- What is your value proposition to the customer?

- What kind of ROI can your customer expect by using buying your product/service?

- What pain are you eliminating?

- Are you selling vitamins, aspirin or antibiotics? (I.e. a luxury, a nice-to-have, or a need-to-have)

WHAT IS YOUR MARKET OPPORTUNITY AND HOW BIG IS IT?

- How big is the market opportunity you are pursuing and how fast is it growing?

- How established (or nascent) is the market?

- Do you have a credible claim on being one of the top two or three players in the market?

One you have chosen a path and climbed the mountain, staying on top, defending the business from competition and copy-cats through continued innovation and customer loyalty will become the primary focus. The next post in this series will look at some questions investors ask to understand your approach to maintaining the value you have created.