Understanding the questions behind a VC’s questions: Part 1 — What the F is “fit?”

If you force the fit you may lose the feel

Over the past few months I have looked at hundreds of potential investments and I have had to say no to all of them. I knew this would be the case when I made the transition from entrepreneur to investor (see Josh Kopelman’s thoughts on this here). In a meeting with an entrepreneur last week, he told me that another VC had described their job as saying no. I disagree. The job is to say yes, but finding the right fit is difficult. Over the years many people who are much smarter and who have much more experience as investors have written about the questions that an entrepreneur should expect from a VC and I have linked to my favorite example from Brad Feld, here. I love what Brad wrote and have looked to it as a guide for my meetings with founders. But after I have answers to these 15 questions, in the work after the meeting, the analysis and decision making, I am really focused on five questions that determine how well a given investment opportunity fits with our model at First Round.

How deep is the hole we are climbing into?

How long will it take us to climb out (to sustainability)?

How far to the summit?

How is the view?

Is it a match?

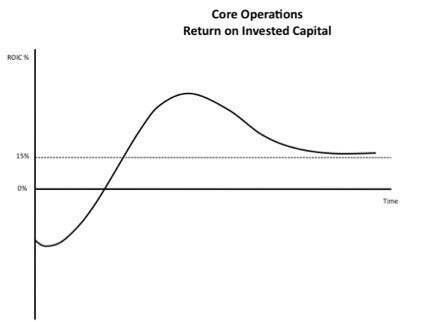

The first four questions are loosely based on the return on invested capital curve developed by David Wessels in his book on valuation.

Return on Invested Capital = (Net Income — Dividends)/Total Capital and is reported as a percentage. The goal of investments is to generate ROIC that is higher than the weighted average cost of capital (hurdle rate or WACC). Andy Metrick’s research (chapter four in his book) suggests that the WACC in VC is about 15% and so I have labeled the graph that way, but this can be anything north of the risk free rate in reality. The curve below illustrate the ROIC over the life of a company assuming outside equity investment and long-term success.

[caption id=”attachment_204" align=”aligncenter” width=”434" caption=”It’s a hell of a ride”]

[/caption]

I will try to group Brad’s 15 conversational questions with by the five investment analysis questions over the rest of this week in separate posts. I hope the series of posts serves as a form of translation tool and helps provide incremental transparency into the VC decision making process for entrepreneurs. I also hope it helps founders think through how to sell investors on the value in their company, not just the product or service the company is selling.