If you invest in lean start-ups, you better build a platform

This post is based on an Ignite talk I did at Lean Start-up NYC two weeks ago. (The video of the talk will be here at some point…)

I argued that the Lean Start-up movement is about leveraging platforms and because of this today’s investors need to build platforms that make company building more efficient. Optimization of these platforms will force firms to focus by stage and partners to invest in helping entrepreneurs get maximum leverage from their firm’s platform.

(I also talked about how this impacts the value of brand, but will save that for another post.)

The talk was 20 slides over 5 minutes. Here are a few of the most relevant slides with commentary below each one:

Today’s entrepreneurs are not only innovating on the products and services they are building, but the best are innovating on the way they build, scale and bring these products and services to market.

This reality creates a disconnect between investors and entrepreneurs that is especially painful when ideas got funded and then do not work. The old VC playbook says when an idea doesn’t work, you write another check. If it still doesn’t work, you fire the CEO and then write another check.

You can do more experiments or bigger experiments, but you cannot buy better results from the market because product-market fit is not for sale. This is the root of the disconnect.

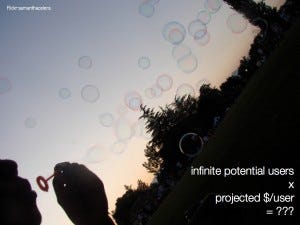

Capital will continue to slide toward commodity status as entrepreneurs leverage platforms to build more and more for less and less.

For investors, the combination of cheap options and potential for explosive growth of a few companies has created an environment where there is more risk in not funding something than in funding a little bit of everything.

But there is hope because the lean start-up is a return to old school company creation and investors are learning. Entrepreneurs continue to compress the innovation stack, remove commodity steps in the company building process and focus on creating the unique elements of their products and services.

The most innovative investors are building platforms to support this new type of entrepreneur and this new/old company creation process.

With the best entrepreneurs leveraging platforms to build companies more efficiently and forward thinking investors building platforms to support these founders, I think we are starting to see a convergence around how best to create enterprise value.

When everyone has access to the same pieces, the same building blocks, the same library, creativity in the use of the tools becomes critical and the primary source of differentiation and defensibility.

The best entrepreneurs will choose to build on the platforms that are tuned for their specific stage guided by a partner focused on their specific needs. The best investors will build platforms to accelerate companies between specific inflection points in their growth.

The market will recognize that companies with 0–4 employees vs. 4–40 vs. 40+ have divergent needs and cannot be supported by a single platform in a meaningful way.

I hope this will force a return to equilibrium with investors and entrepreneurs aligning platform, partner and capitalization level with stage of company and state of product market fit.