Honor and termsheets

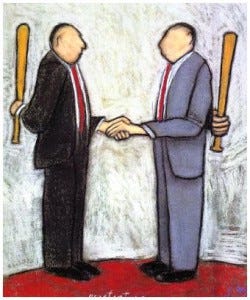

[caption id=”attachment_507" align=”alignleft” width=”250" caption=”There is no honor in this deal”]

[/caption]

At a lunch with a friend who is running his own company and working to raise money, the topic of termsheets came up (First Round is not an investor in his company and he was not talking to me about an investment) but it got me thinking about deal terms. It is no secret that investment dollars are flowing and the number of deals being done is rising. Along with this increase in the pace of funding, more termsheets are being put in front of entrepreneurs on each deal. In this environment, I encouraged him to look for simple terms that are easy to understand, straightforward to negotiate and that create long-term interest alignment. I told him to look for honorable terms.

My first experience with the value of simple terms came my freshman year in college. I went to Haverford College, a small Quaker school outside Philadelphia. The Haverford community is managed by a simple Honor Code that governs academic and social life at the college. It can be summarized as, “Be respectful. Be Honest.”

This sounds like utopia and I was skeptical until my first exam. The test was set for 90 minutes and was closed book, closed notes. I came to class prepared for the exam and was surprised as the professor began to teach a full lecture. At the end of class she asked us to pick up an exam, reminded us of the closed book, closed notes status and the time limit. She then asked us to return the exam by the end of the week.

With this responsibility, and the ability to take the exam in my room with the door closed, I experienced the value of simple terms and clear expectations. I took the exam with my book closed and without my notes. I did not finish in time and chose to stop. The lesson in that moment was far more valuable than anything I learned the rest of the semester. Honor is expected in governance by simple terms.

When I think about investment deal terms, I am convinced that no level of contract engineering can protect you as much as mutual respect and transparency. The simplest investment terms would be agreement on valuation based on the entrepreneur’s vision and the investor’s assessment of risk, a handshake and a check.

Any complexity beyond this represents protection in the event things go wrong. This protection is for both sides and is necessary, but the level of downside protection your investors ask for, embodied in the terms of the deal, tells you something about their approach to your business. Your level of comfort sitting across the table before an investment is made is the best indicator of the confidence you will have sitting on the same side of the table in the future. How investors (and entrepreneurs) negotiate terms is the way they will manage and advise the company.

This early interaction is signal, not noise. When you raise money you should look for signals that indicate a long-term partnership rather than a transaction, you should look for a partnership based on simple terms like, “Be respectful. Be Honest.”